dc income tax withholding calculator

Capital has a progressive income tax rate with six tax brackets. If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271.

Tax Calculator Return Refund Estimator 2022 2023 H R Block

New job or other paid work.

. D-4 Fill-in Employee Withholding Allowance Certificate. Federal and DC Paycheck Withholding Calculator. Determine the dependent allowance by applying the following guideline and subtract this amount from the.

Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. See withholding on residents nonresidents and expatriates. Social Security Tax is equal to 62 of your employees taxable wages up to an annual.

Withholding Formula District of Columbia Effective 2021. Withholding Formula District of Columbia Effective 2022. The local income tax system in Washington DC is a progressive tax system.

Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages. Subtract the nontaxable biweekly Federal. On the File the FR-900 page enter the DC Income Tax Withheld on Line 1.

Income Tax Calculator 2021. Check your tax withholding every year especially. Your average tax rate is 1198 and your.

If you have a third job enter its annual. Monday to Friday 9 am to 4 pm except District holidays. The amount of income tax your employer withholds from your.

When to Check Your Withholding. If there is a Tax. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or.

1101 4th Street SW Suite 270 West Washington DC. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. If applicable enter the total payments made on Line 2.

For employees withholding is the amount of federal income tax withheld from your paycheck. 400 plus 6 of the excess over 10000. Enter annual income from highest paying job.

FICA taxes are made up of two components Social Security Tax and Medicare Tax. When you have a major life change. Has relatively high income tax rates on a nationwide scale.

OTR Tax Notice 2022-08 District of Columbia Withholding for Tax Year 2022. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am to 530 pm Monday. File with employer when starting new employment or when claimed allowances change.

Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher.

The income tax rate in Washington DC state for tax years beginning after 12312021 are. 4 of the taxable income. Enter annual income from 2nd highest paying job.

Overview of District of Columbia Taxes. This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Please select the appropriate link from.

Office of Tax and Revenue. It depends on. How to File a Withholding Wage Tax Return.

Subtract the nontaxable biweekly Federal. The amount of income you earn. The tables below reflect withholding amounts in dollars and cents.

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

The Top Tax Question On Google Will Surprise You Abc News

Individual Income Taxes Urban Institute

Free Llc Tax Calculator How To File Llc Taxes Embroker

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

With New Tax Law I R S Urges Taxpayers To Review Withholdings The New York Times

Are You Having Too Much Or Too Little Federal Income Tax Withheld From Your Pay Capital Area Asset Builders

State Withholding Form H R Block

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Indiana State Income Tax Withholding Calculator Internal Revenue Code Simplified

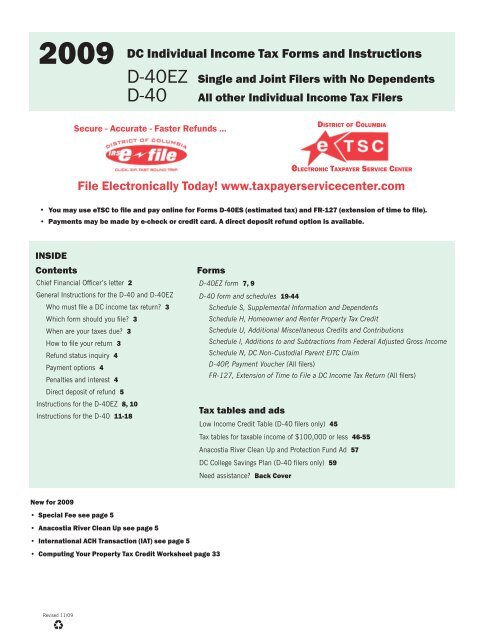

2009 Dc Individual Income Tax Forms And Instructions D 40ez D

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Botched Your Tax Withholding In 2018 It S About To Get Complicated

Covid 19 Response Tax Implications Lewis Brisbois Bisgaard Smith Llp

Tax Season 2022 Last Day To File And Where To File In The Dmv Wusa9 Com

Final 2020 Federal Income Tax Withholding Instructions Released

How Do State And Local Individual Income Taxes Work Tax Policy Center