j-51 tax abatement rent stabilization

A building owner cannot use the luxury decontrol provisions if the building is receiving J-51 benefits and the only reason the building is in rent stabilization is to receive J-51 benefits. Additionally some buildings that are smaller or were built after 1974 are covered by rent-stabilization because the developer or owner chose to enter those buildings into the rent.

New York Allows J 51 Tax Exemption For Buildings To Expire

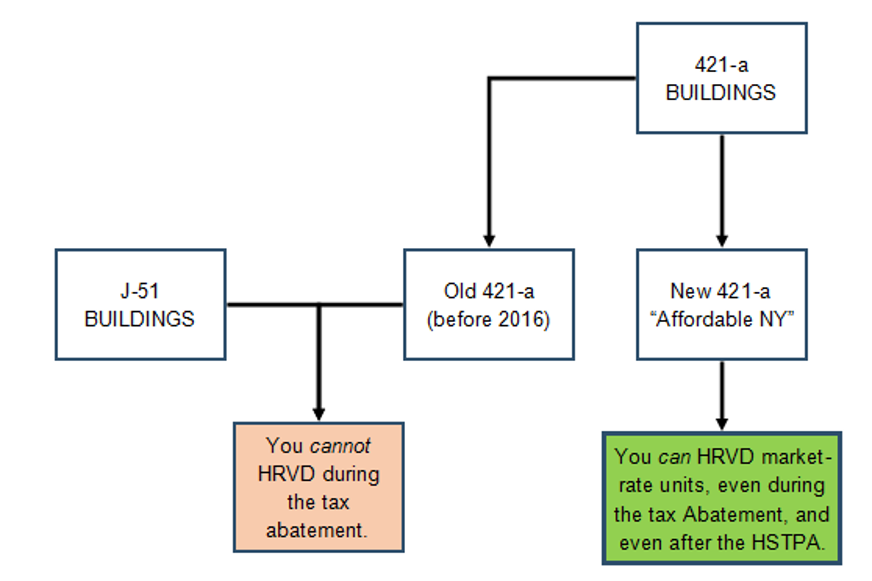

If it is recently constructed the abatement may be known as a 421-a tax abatement.

. 276 Fifth Ave Suite 704 New York NY 10001 646 741-6101. J-51 Tax Abatement Rent Stabilization. The expiration of a J-51 tax abatementwhich gives landlords tax incentives to make major repairs on older buildings and requires them to provide renters with stabilized.

Reduced to less than 500. Your abatement application must be received by the board of assessors within three years. The expiration of J-51 benefits does not always affect the stabilization status of buildings.

According to the New York City Rent Guidelines Board landlords may or may not be able to raise the rent in buildings with J-51 benefits. No abatement or refund of less than 500 may be made. New York Citys J-51 program is a tax exemption andor abatement program for multi-family property ownersEN1 Projects eligible for J-51 include moderate and gut.

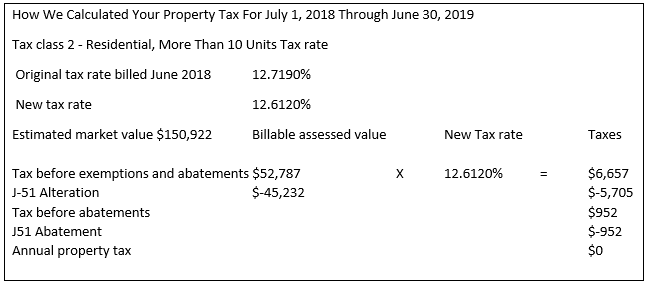

It also decreases your property tax. Eligible projects for this program include. The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

Rents in these units. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction. It depends on whether rent.

Households must earn either less than 50 or 60 of the area median income depending on the set-aside option chosen by the property owner to qualify for these units. Enactment of a nuisance abatement law by a town within the county provided that the function has not been transferred by the town to the county level under the provisions of a county. The rent is restored at the end of the tax abatement period pursuant to a DHCR issued rent restoration order for rent controlled apartments and an owner filed notice for rent stabilized.

Not only must a landlord receiving 421-a or J-51 benefits offer a rent stabilized lease but the owner must inform the tenant about the tax. The J-51 tax abatementwhich offered tax incentives for landlords to repair and renovate older buildingsoffered owners serious tax breaks but with the stipulation that. Strong Notice Requirements.

The J-51 Tax Incentive program is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multi-family housing. The benefit varies depending on the buildings location and the type of improvements. 101 Sunnyside Blvd Suite 103 Plainview NY 11803 516 741-4723.

The J-51 Tax Abatement program is a tax incentive offered by the city of New York to encourage owners of multi-unit dwellings to make repairs and improvements to their properties. Eligible projects for this program include.

Tax Exemption And Tax Abatements Icap Icip 421 A J 51 Twll

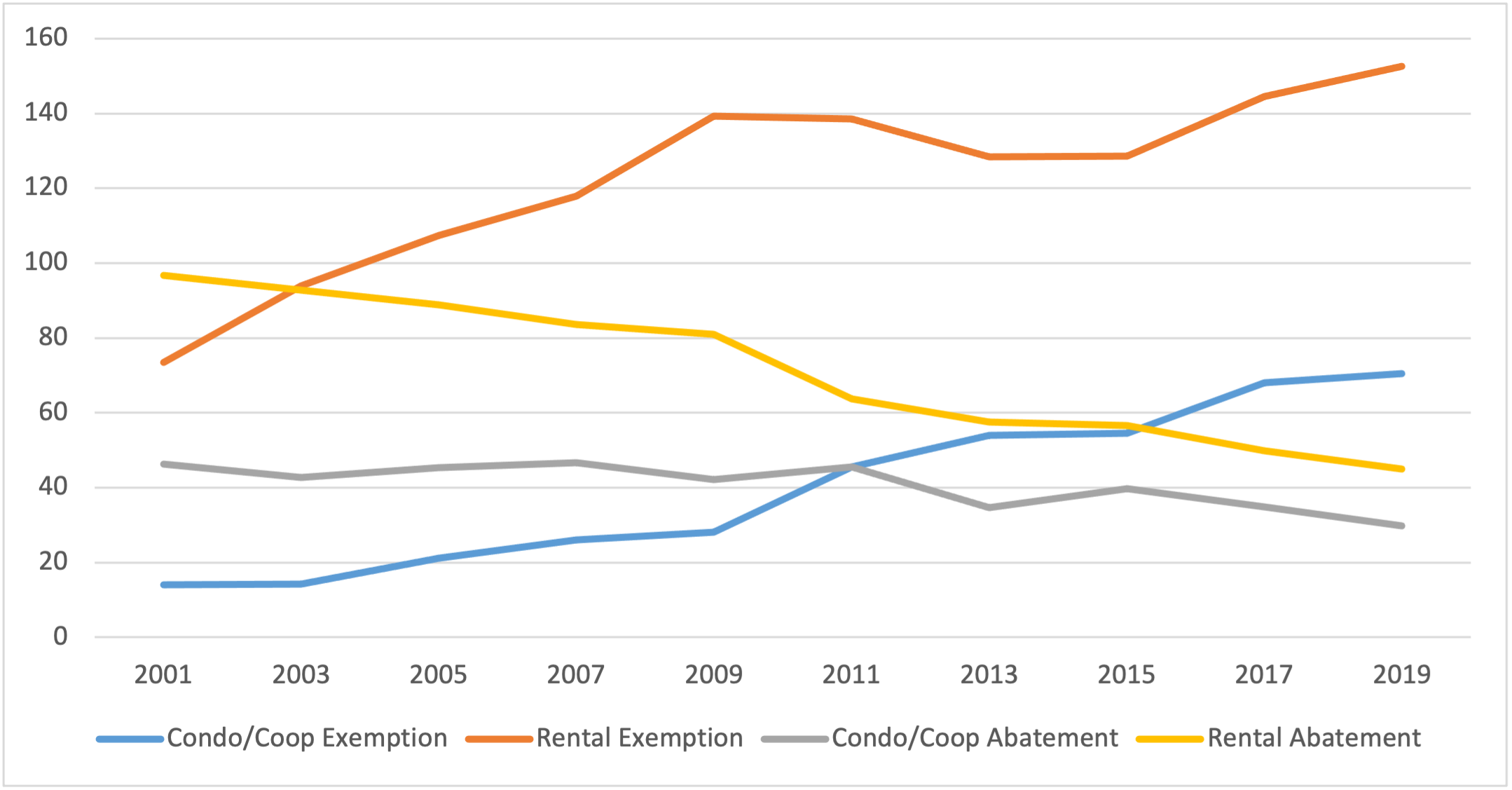

J 51 Tax Program Decline Hpd To Revise

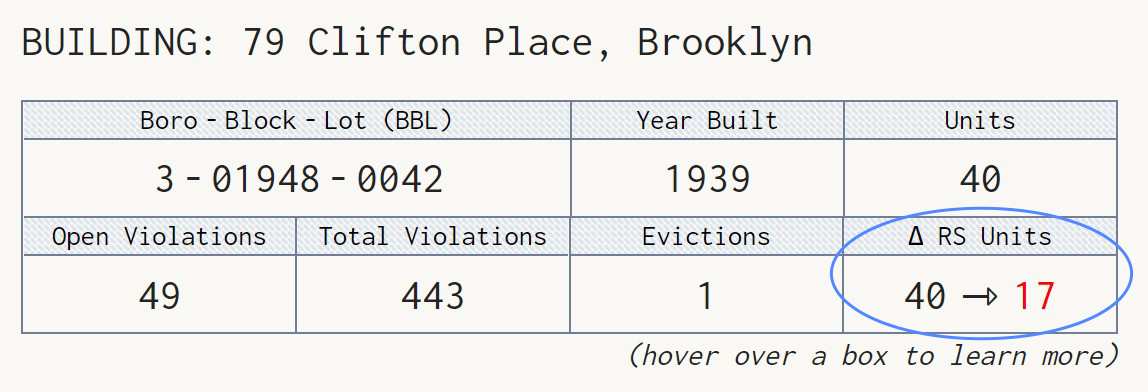

Rent History 101 Is Your Landlord Illegally Overcharging You Justfix

Testimony Hearing On Exemption From Taxation Of Alterations And Improvements To Multiple Dwellings Community Service Society Of New York

Dwindling Finds Nyc S Last Batch Of New Condos With 421 A Tax Abatements Cityrealty

J 51 Tax Abatement For Co Ops And Condos Is Stuck In Limbo Habitat Magazine New York S Co Op And Condo Community

How Do I Know If My Tenant Is Rent Stabilized Or Not Itkowitz

Buying An Apartment With A J 51 Tax Abatement Hauseit

J 51 Guidebook Fill Out Sign Online Dochub

Housing Leaders Call On City To Renew J 51 Tax Program Real Estate Weekly

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Can New Buildings Be Rent Stabilized Yes They Definitely Can Justfix

Buying An Apartment With A J 51 Tax Abatement Hauseit

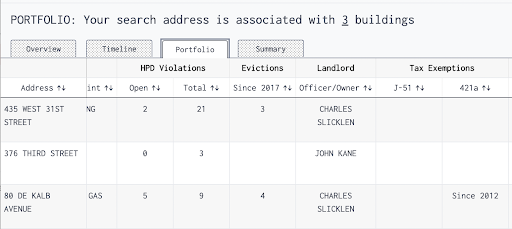

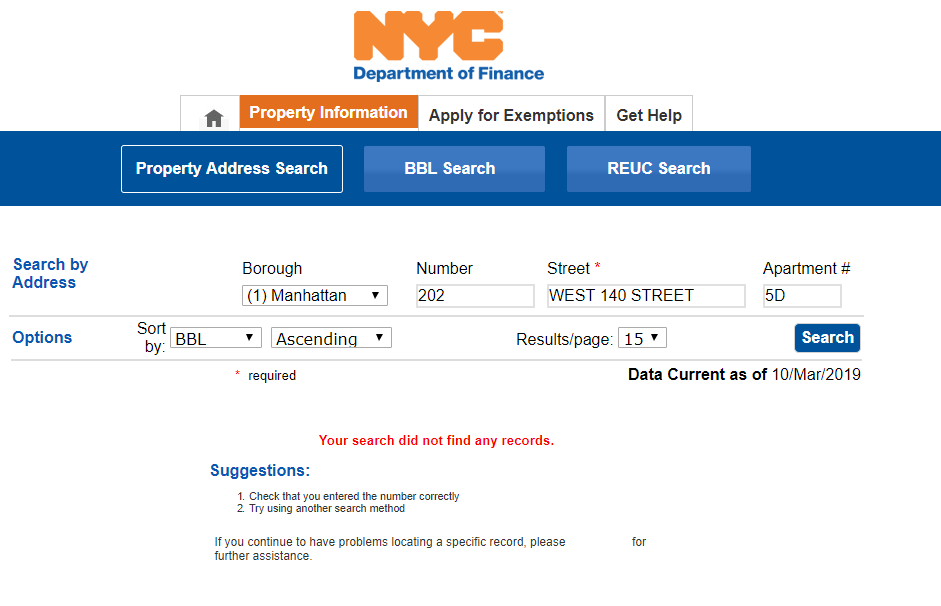

Evaluating Whether High Rent Vacancy Deregulation Really Happened Itkowitz

Rent Stabilization 101 Am I Rent Stabilized Rentcement

What Is A Tax Abatement Should You Buy A Home With One Localize

Owners Call On City To Reauthorize J 51 Tax Abatement As Part Of Ida Recovery Real Estate Weekly